city of richmond property tax rate

RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. It is estimated that by freezing the rate the city will provide Richmonders more than.

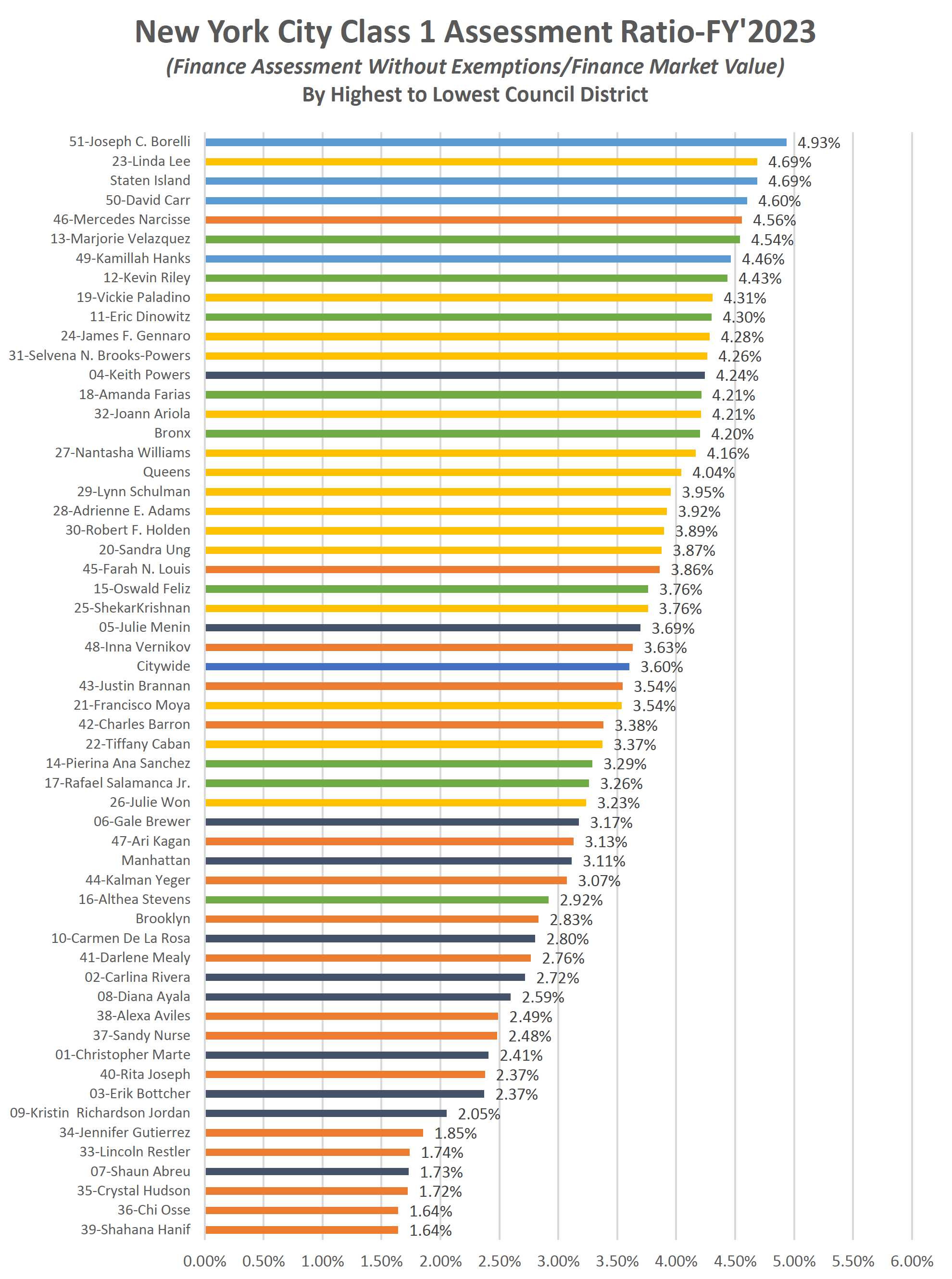

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Richmond City collects on average.

. Real Estate and Personal Property Taxes Online Payment. Other Services Adopt a pet. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Richmond City Council is considering lowering the real property tax rate as property values across the city increased 13 on average from a year prior. City of Richmond adopted a tax rate. Understanding Your Tax Bill.

Colleen Cargo City Assessor Email Richmond City Hall 36725 Division Road Richmond MI 48062 Ph. These agencies provide their required tax rates and the City collects the taxes on their behalf. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and.

City of Richmond City Hall 402. For information and inquiries regarding amounts levied by other taxing authorities. Property Tax Vehicle Real Estate Tax.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Drop Box at City Hall. Search by Property Address Search property based on street address If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000.

Property Taxes are due once a year in Richmond on the first business day of July. Yearly median tax in Richmond City. City of Richmond City Hall 402.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Paying Your Property Taxes. The tax rate for a vehicle worth less than 25000 is 150 per 100 of.

Object Moved This document may be found here. Electronic Check ACHEFT 095. Due Dates and Penalties for Property Tax.

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Due Dates and Penalties for Property Tax.

City of Richmond adopted a tax rate. The City Assessor determines the FMV of over 70000 real property parcels each year. Manage Your Tax Account.

Richmond residents will have until July 4 to pay their property. In Person at City Hall. Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website.

To pay your 2019 or newer property taxes online. Richmond Va Residents Can Now Easily Pay Their Real Estate And Personal Property Taxes. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

295 with a minimum of 100. These documents are provided in Adobe Acrobat PDF format for printing.

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Richmond Economic Development Corporation Richmond Tx Official Website

Bay Area Cities Where Homeowners Saved Up To 30k On Property Taxes In Real Estate Boom

Municipal Court City Of Richmond

Virginia Property Tax Calculator Smartasset

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

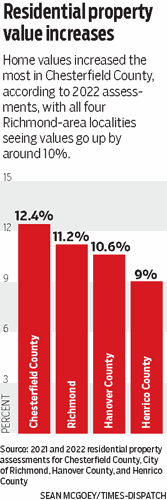

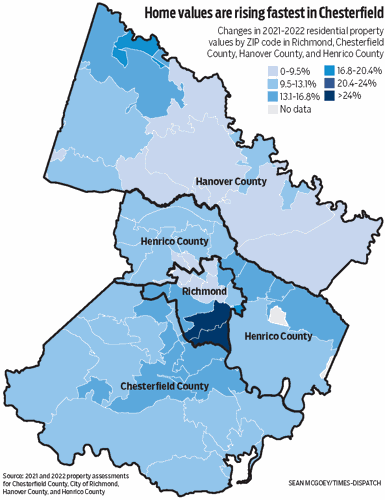

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos

Augusta School Board May Increase Millage Rate Which Would Raise Taxes

Taxes Incentives Greater Richmond Partnership Virginia Usa

Toronto Property Taxes Explained Canadian Real Estate Wealth

City Of Richmond Adopts 2022 Budget And Tax Rate

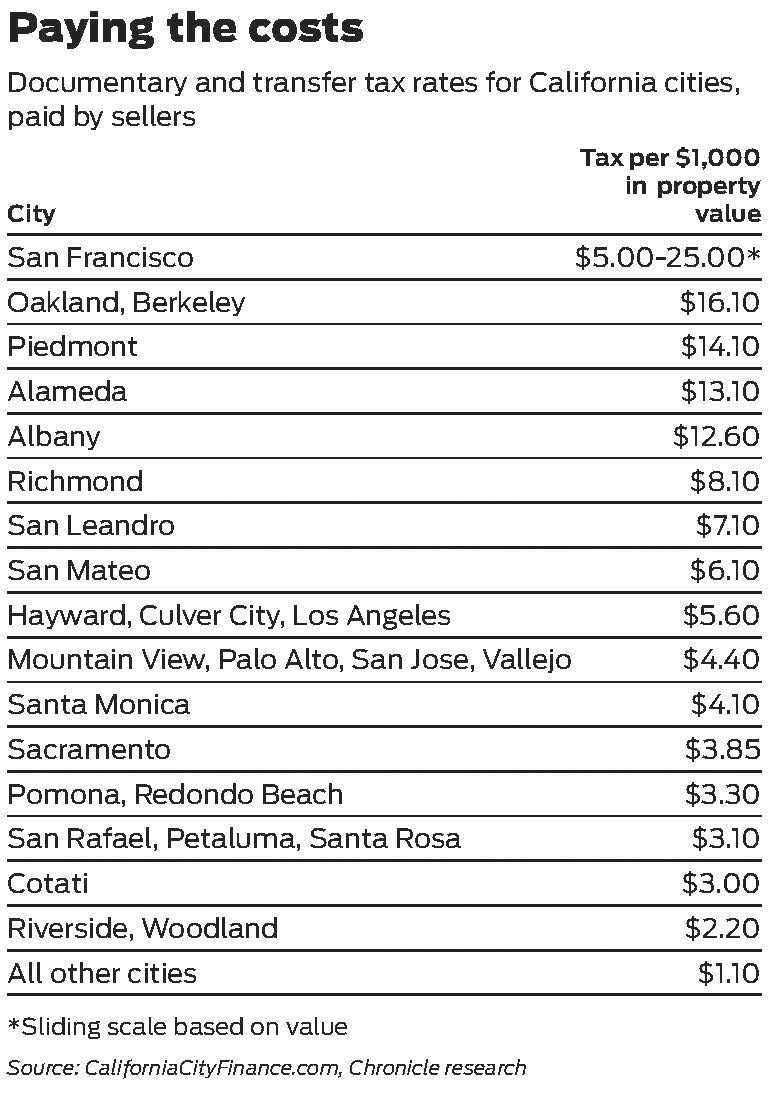

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Deadline To Pay Richmond Property Taxes Approaching Richmond News

Council Directs Staff To Advertise A Ten Cent Increase On The Charlottesville Property Tax Rate Information Charlottesville